Software To File Form 1065

If it’s free, it’s for me! With few exceptions, no one really enjoys filing their taxes, so why not reduce the sting by doing it for free? Free is everyone’s favorite price for anything. However, there are restrictions on who, how, and what can be e-filed for free. These filers aren’t invited to the party: • Businesses that are required to file as a C corporation using Form 1120 or an S corporation using Form 1120S. • Partnerships using Form 1065. • Estates and trusts using Form 1041. • Nonprofits using Form 990.

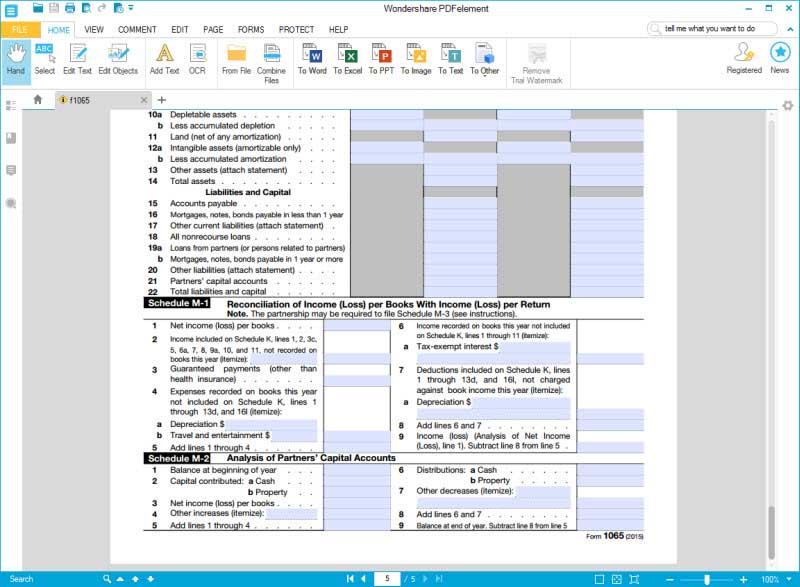

Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065. On this form, you'll be asked to provide the partnership's total income or loss. You will list deductions such as salaries, guaranteed payments to partners, rent, repairs, taxes, depreciation and employee benefit programs.

The good news is that just about everyone else can e-file for free. E-file means electronic filing, and it allows for tax returns that have been completed on a computer to be sent to the IRS. While any tax return can still be mailed in, e-filed returns have some nifty advantages. The biggest is speed, which is especially important if you are expecting a refund. Vopt 9 21 Setup Keygen Download. Most e-filed returns are accepted and processed by the IRS in less than 24 hours, versus up to six weeks or more for paper-filed returns. The reason for the difference is because most e-filed returns are not looked at by humans. They are processed digitally and, unless there is an error, they are almost immediately approved.

Two Ways to E-File for Free You can use either commercial software or the IRS’, available Jan. The difference between commercial tax preparation software and the fillable forms from the IRS is substantial. The commercial tax preparation software guides you through the process of preparing your return by asking questions and using your responses to suggest and complete forms. With the IRS’ fillable forms, you must decide what forms you need to complete. Many of the commercial tax preparation software companies offer free federal e-file; the best of them can be found. The free commercial software comes with restrictions that start with income. To use the free federal version, your income must be less than $60,000 per year.

In most cases, you are limited to either the 1040 EZ or the 1040A (the short form). If you itemize or your income is above the limits, they will charge you on a sliding scale depending on the complexity of your return. TurboTax recently announced. In-Person Tax Preparation Help The IRS offers two programs that provide hands-on assistance completing federal income tax returns. VITA (Volunteer Income Tax Assistance) provides free in-person tax help at community and neighborhood centers around the country. Trained IRS volunteers can assist people with disabilities, limited English language skills, and others who earn less than $53,000 per year. VITA volunteers can prepare and e-file basic tax returns.

The IRS has a second volunteer program for senior citizens called Tax Consulting for the Elderly, or TCE. This program is also manned by IRS certified volunteers who are knowledgeable about issues of concern to older taxpayers, such as pensions and retirement-related issues. You can search for either a VITA or TCE center on the or call toll free 1-800-906-9887. Even More Help The IRS recognized that its website and tax documentation can be intimidating and confusing, so it created a sort of that has 25 common questions, such as What is my filing status? Can I deduct my moving expenses? And Who can I claim as a dependent? When you click on a question, rather than having to wade through pages of documentation, you are guided through a series of questions based on your circumstances.